Cocoa and Cocoa Preparations (Chapter 18)

Lilla Zsitnyanszky

24. Oktober 2023

Welcome to our latest blog post, where we delve into a delicious topic: the classification of cocoa and cocoa products. What specific considerations must be taken into account when classifying them? Why isn't white chocolate classified as chocolate according to the customs tariff? You'll find the answer right below.

The following products are assigned to Chapter 18:

1. Raw, roasted, whole, or broken cocoa beans (Pos. 1801).

2. By-products and residues from the production of cocoa powder or cocoa butter (cocoa shells, cocoa husks, and other cocoa waste) (Pos. 1802).

3. Cocoa paste (Pos. 1803).

4. Cocoa butter, fat, and oil (Pos. 1804).

5. Cocoa powder without sugar or other sweeteners (Pos. 1805).

6. Chocolate and other cocoa-containing food preparations (Pos. 1806).

Classification of Cocoa-Containing Food Preparations

In general, it should be noted that all food products from the confectionery industry containing any amount of cocoa, sweetened cocoa powder, chocolate powder, chocolate glaze, and generally all cocoa-containing food products are assigned to Chapter 18.

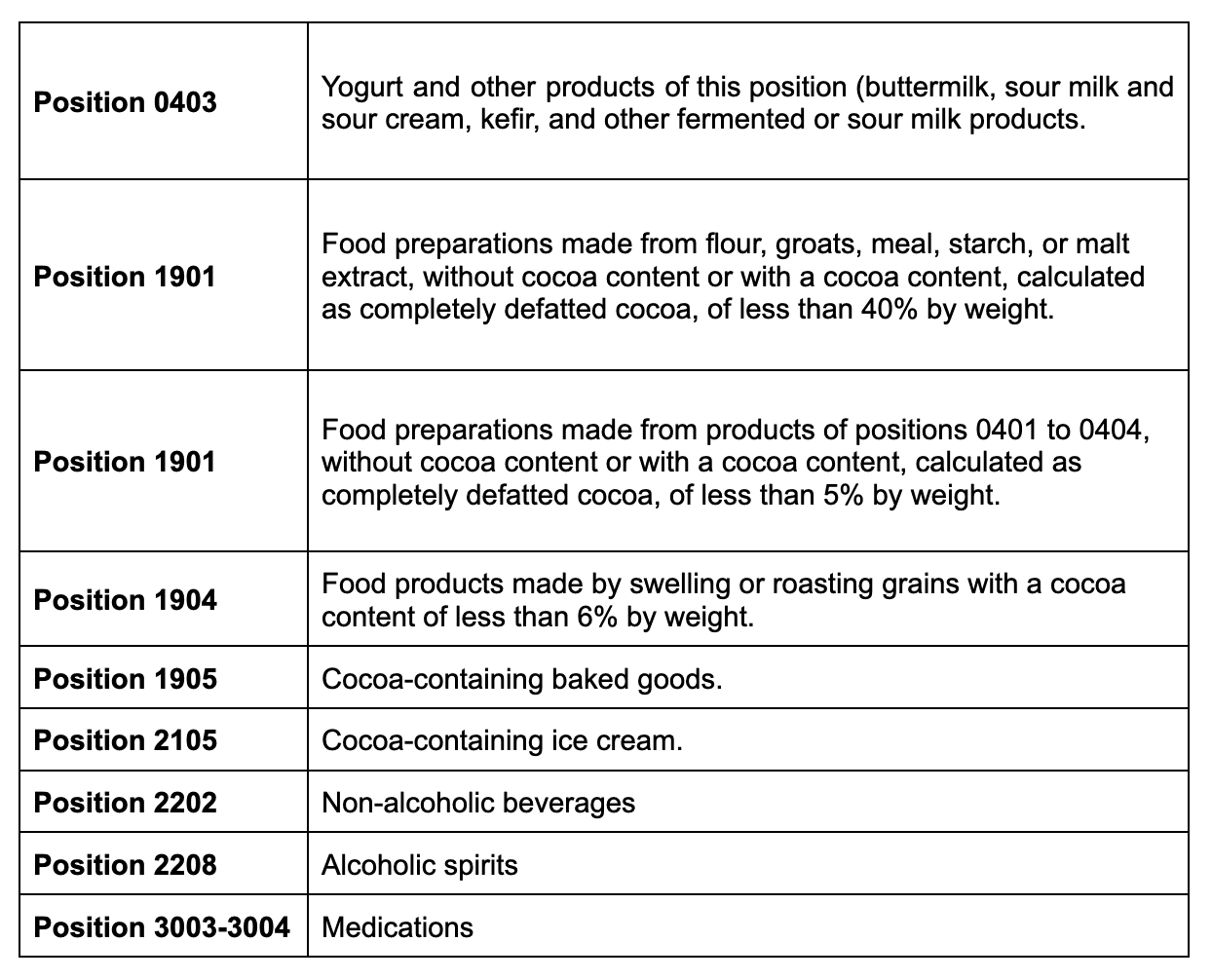

However, there are products that cannot be classified in this chapter. These include the following:

Chocolate vs. White Chocolate

Chocolate is composed of cocoa mass, cocoa butter, and sugar. However, ingredients such as milk, coffee, nuts, almonds, orange peel, and others can also be added. Chocolate and chocolate products can come in the form of blocks, bars, tablets, bars, pralines, beads, particles, or powdered products. Alternatively, they can be available as filled products with cream, fruits, alcohol, other spirits, etc.

On the other hand, white chocolate, which consists of sugar, cocoa butter, milk powder, and flavourings, and contains at most small amounts of cocoa, is classified as confectionery in position 1704 (cocoa butter is not considered cocoa).

traide Support

There is a wealth of information and legal provisions to consider when it comes to classification. If the classification is incorrect, everything is incorrect: customs duties, export declarations, preferential treatment, export control provisions, excise taxes, sales taxes, and so on.

Why Choose traide AI?

At traide, we are dedicated to the customs tariff number. Our goal with traide is to offer an intelligent software package that achieves and maintains the completeness, currency, and integrity of an entire company's product master data (sometimes millions of products) according to customs tariff requirements over time. In addition, we address the issues that arise before the actual classification process and significantly influence it. This includes, in particular, the quality of the product description, which often provides inadequate information or presents this information in an unstructured and distributed manner (e.g., in HTML format on a webshop or in product data sheets).

At its core, traide software functions as an intelligent digital customs tariff expert. It helps to quickly find the correct customs tariff number, acting as a "Tariff Assistant." It also automatically checks already classified product inventories for formal and substantive accuracy and provides feedback to the user in case of errors. The result is significantly increased throughput and a lower error rate for classified products. This frees up staff resources, creates room for scaling, and enhances security.

Do you have any questions about this? Feel free to write to us! We are happy to assist you.

Contact: info@traide.ai